Understanding the details and features of your bank card is crucial for managing your finances effectively. Whether you’re a new cardholder or have had your card for years, questions and uncertainties can arise. This article aims to address the most common frequently asked questions (FAQs) about bank cards in South Africa, providing clear and concise answers to help you navigate your card usage with confidence. Here’s everything you need to know about What’s On My Card? South Africa.

What’s On My Card? FAQs

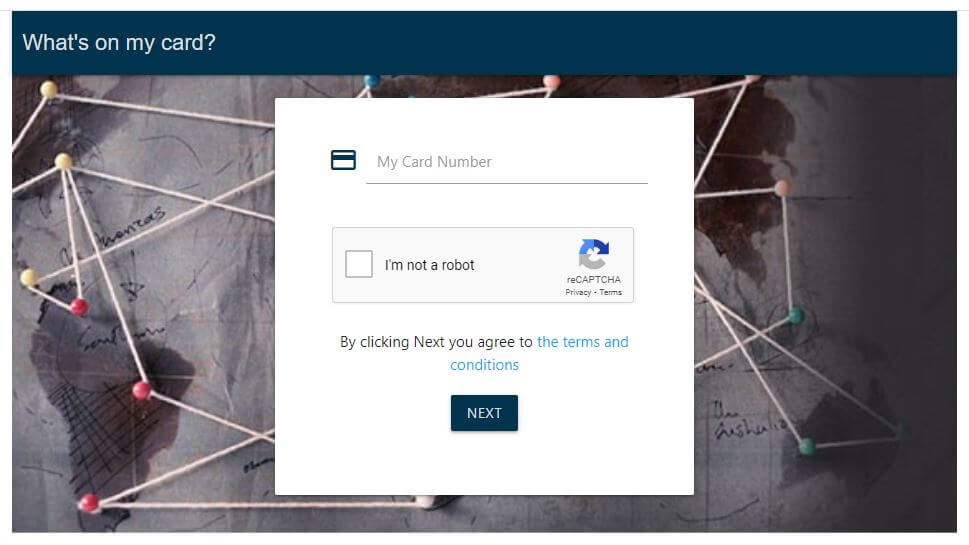

1. What is ‘What’s On My Card?’

What’s On My Card? is a website that allows users to check the remaining balance on their prepaid gift cards. Users can enter their card details to view the current balance and transaction history of their card. This service is useful for managing and keeping track of gift card funds. What’s On My Card also refers to the various details and features associated with your bank card. This includes your card number, expiration date, CVV, and any specific features or benefits your card may offer.

2. How do I check my card balance?

You can check your card balance through various methods:

- Online Banking: Log in to your bank’s online portal to view your balance.

- Mobile Banking App: Use your bank’s mobile app to check your balance.

- ATM: Insert your card into an ATM and select the balance inquiry option.

- Bank Branch: Visit a bank branch and ask a teller for your balance.

- SMS Banking: Some banks offer balance inquiries via SMS.

3. How can I report a lost or stolen card?

To report a lost or stolen card, you should immediately contact your bank’s customer service hotline. Most banks in South Africa have 24/7 hotlines specifically for reporting lost or stolen cards. Additionally, some banks allow you to report this through their mobile apps or online banking portals.

4. What should I do if I forget my PIN?

If you forget your PIN, you can reset it by:

- Online Banking: Some banks allow you to reset your PIN online after verifying your identity.

- Mobile App: Use your bank’s mobile app to reset your PIN.

- ATM: You might be able to reset your PIN at an ATM, depending on your bank.

- Branch Visit: Visit a branch with your identification documents to reset your PIN.

5. Are there fees associated with using my card?

Yes, there can be various fees associated with using your card, including:

- Annual Fees: A yearly charge for using the card.

- Transaction Fees: Charges for certain transactions, such as ATM withdrawals, foreign transactions, or balance inquiries.

- Late Payment Fees: If you miss a payment due date.

- Interest Charges: If you carry a balance on a credit card.

Check with your bank for a detailed list of fees specific to your card.

6. How do I protect my card from fraud?

To protect your card from fraud:

- Keep your PIN confidential: Do not share your PIN with anyone.

- Monitor transactions: Regularly check your statements for unauthorized transactions.

- Use secure ATMs: Use ATMs located in safe, well-lit areas.

- Report suspicious activity: Immediately report any suspicious activity to your bank.

- Enable alerts: Set up transaction alerts via SMS or email.

7. Can I use my South African bank card internationally?

Yes, most South African bank cards can be used internationally. However, you should:

- Notify your bank: Inform your bank about your travel plans to avoid your card being flagged for suspicious activity.

- Check fees: Be aware of any foreign transaction fees that may apply.

- Know your card’s limits: Ensure you are aware of your daily withdrawal and spending limits.

8. What is a CVV and why is it important?

The Card Verification Value (CVV) is a three-digit number found on the back of your card. It is used to verify your identity when making online purchases. The CVV is important because it adds an extra layer of security, helping to prevent unauthorized transactions.

9. How do I set up online banking for my card?

To set up online banking:

- Register on your bank’s website: Follow the registration process, which usually involves providing your card details and creating a username and password.

- Verify your identity: You may need to verify your identity through a code sent to your phone or email.

- Log in: Once registered, you can log in and start managing your account online.

10. What should I do if I suspect fraudulent activity on my card?

If you suspect fraudulent activity:

- Contact your bank immediately: Report the suspected fraud to your bank’s fraud department.

- Block your card: Temporarily block your card through your bank’s app or customer service.

- Review statements: Check your recent transactions for any further unauthorized charges.

- Request a new card: Your bank may issue a new card if fraud is confirmed.

Conclusion

Being well-informed about your bank card and its features can significantly enhance your financial security and convenience. By understanding the answers to these common FAQs, you can use your card with greater confidence and ensure your financial transactions are both secure and efficient. If you have more specific questions, always reach out to your bank’s customer service for assistance.

Image Courtesy: www.whatsonmycard.com